41 us banking system diagram

The participation constraints are explained in the diagram below −. Here, the customer to Loan is partial participation and the loan to the customer is total participation. Total participation. The participation of an entity set E in a relationship set R is said to be total if every entity in E Participates in at least one relationship in R.

How it works: the open banking providers connect to the bank's system via API to retrieve the data. Often, the API layer between the bank and the open banking provider is provided by an API ...

Point of sales banking. The electronic medium has always provided the innovative base to the banking institutions in their progressive journey of providing better, safe, and easy services to the customers. The earliest mode of transactions, the cheques, were first introduced in Indian banking system by Bengal Bank in 1784. Then came ATMs in 1987.

Us banking system diagram

The below image is a representation of the workflow diagram of any basic Expert System. As we have discussed before the inference engine, is the heart of the Expert system. ... these systems can help in fraud detection if we talk about banking and ... all their various systems are available which can be used by us. Generation of the expert ...

The banking system comprises the majority of lending to the non-financial private sector in New Zealand (figure 2). Direct capital market funding (issuance of corporate bonds) and non-bank lending institutions (NBLIs) together account for only 6 percent of non-financial private sector borrowing.

Diagram showing a business process flow for Abhay the accountant. Two steps in the process ("Lookup employee banking details" and "Reimburse cash to applicant") are circled in red to indicate the potential areas where Power Automate can reduce human errors by automating these steps.

Us banking system diagram.

Use Case Diagram. As the most known diagram type of the behavioral UML types, Use case diagrams give a graphic overview of the actors involved in a system, different functions needed by those actors and how these different functions interact.. It's a great starting point for any project discussion because you can easily identify the main actors involved and the main processes of the system.

Here are a number of highest rated Online Banking Diagram pictures upon internet. We identified it from trustworthy source. Its submitted by supervision in the best field. We give a positive response this nice of Online Banking Diagram graphic could possibly be the most trending topic afterward we allocation it in google plus or facebook.

This banking system allows customers or users to have access to financial transactions. These transactions can be done in public space without any need for a clerk, cashier, or bank teller. Working and description of the ATM can be explained with the help of the Use Case Diagram .

The code is interchangeably called the bank identifier code (BIC), SWIFT code, SWIFT ID, or ISO 9362 code. To understand how the code is assigned, let's look at Italian bank UniCredit Banca ...

Banking system cloud transformation on Azure: Learn how a major bank modernized its financial transaction system while keeping compatibility with its existing payment system. Migration: Patterns and implementations in banking cloud transformation: Learn the design patterns and implementations used for the Banking system cloud transformation on ...

Core banking infrastructure is the skeleton of our banking system, thereby enabling a wide variety of innovations and enhanced customer experience in the fintech space.

How to Draw a Banking System Flowchart Step 1 Make yourself clear about the detailed steps about how to deposit money, including what documents you should prepare before and who will be in charge of each step.. Step 2.Start drawing a banking system flowchart with a professional flowcharting program. A professional flowcharting program should be a program that has settled everything ready and ...

Putting it all together in an ATM class diagram We have all the classes we need, so our finished class diagram now models the interaction between the bank, a customer, the ATM, and the customer account. The bank class has customers and it maintains the ATM. The customer owns an account and also owns a debit card.

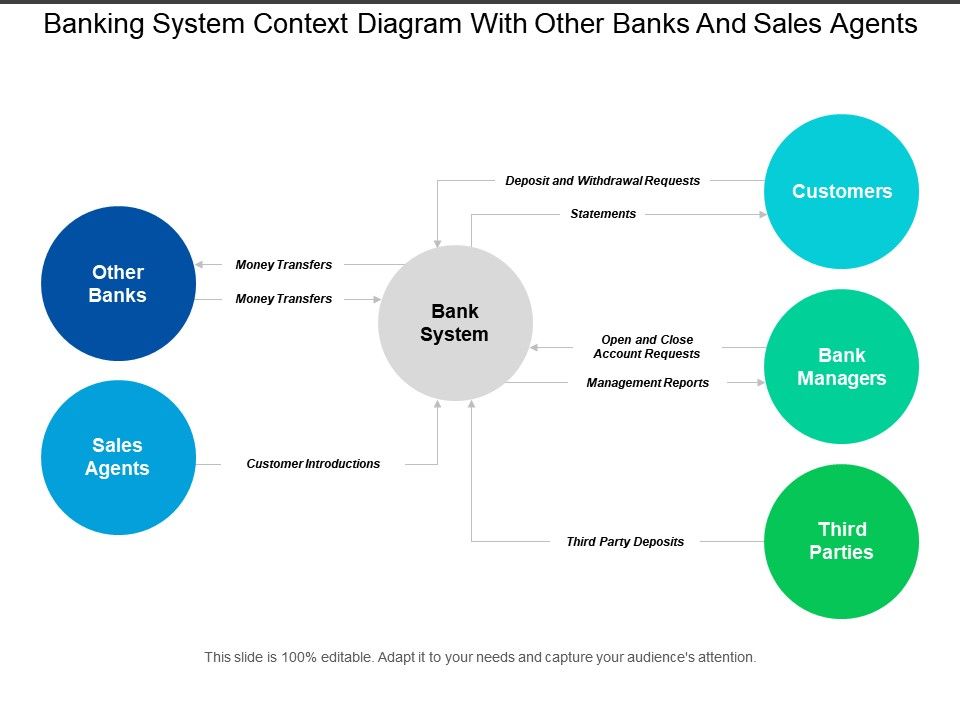

A context diagram is sometimes referred to as a level 0 data-flow diagram. An SCD is drawn to define and clarify the boundaries of the software system. One of the examples of a System Context Diagram would be the check on inflation with a local Bank system where sales agents and other bank employees work in unison to improve productivity. More ...

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007-2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities.

Entity Relationship Diagram (ERD): Apa dan Bagaimana Cara Membuatnya? Basis data atau kerap disebut " database " merupakan kumpulan informasi yang disimpan secara sistematis dalam perangkat komputer sehingga dapat dicari dan diperiksa melalui suatu program komputer saat informasi tertentu sedang dibutuhkan. Ketika mendokumentasikan data ...

This system sequence diagram example is just made for this purpose. Also, the system will also inform the student if they exceeded the allotted time for renting a book and a penalty will apply accordingly. Sequence diagram example for ATM; Edit this diagram. An automated teller machine lets you access your bank account.

8. Bank Name. If you have any questions or concerns about a check, you can contact the bank that is listed on the check. 9. Bank's ABA Routing Number. The ABA routing number is a nine-digit number assigned to your bank by the American Bankers Association. This indicates the bank through which the funds will be withdrawn.

Use case diagram is a behavioral UML diagram type and frequently used to analyze various systems. They enable you to visualize the different types of roles in a system and how those roles interact with the system. This use case diagram tutorial will cover the following topics and help you create use cases better. Importance of use case diagrams.

PLEASE HELP 1.Create a diagram of the U.S banking system and the Federal Reserve System(FRS). Include special financial services of the banking system in your diagram. Be creative in this activity. Pretend you have been asked to . Geography (Ms. Sue) 1).

The Bank has the access to modify the Loan Management System as the Bank can set or modify any policies of the Loan offered by the Bank. Online Banking System - It provides other services like insurance, bill payments, etc. The Level-2 Data Flow Diagram of an Online Banking System is as follows -

6. Contoh Use Case Diagram ATM. Pada use case di atas ada 3 aktor, yaitu : Actor (operator) Nasabah; Dan Bank (Mesin ATM) Penjelasan : Actor atau Operator; Tugas dari operator yaitu : System startup : Operator menghidupkan mesin ATM dan memasukan sejumlah uang ke brankas ATM dan memastikan ATM sudah terkoneksi dengan sistem bank.

Federal Reserve Board announces termination of enforcement action Press Release - 12/23/2021 . Federal Reserve issues update to Payments Study Press Release - 12/22/2021 . Federal Reserve announces approval of application by WSFS Financial Corporation Press Release - 12/17/2021 . Federal Reserve announces approval of application by Webster Financial Corporation Press Release - 12/17/2021

SWIFT (The Society of Worldwide Interbank Financial Telecommunication) is a messaging system that runs on a network of financial institutions globally. It is used by thousands of banks worldwide to communicate information on financial transactions in a secure and standardized way.

Code P0755 refers to a "Shift Solenoid "B" Malfunction.". Most vehicles with automatic transmissions have at least three transmission shift solenoids, namely A, B, and C. Your OBD-II scanner may pick up code P0755 if your powertrain control module (PCM) detects a malfunctioning shift solenoid "B". Your OBD-II scanner may pick up ...

Branch Automation: Form of banking automation that connects the customer service desk in a bank office with the bank's customer records in the back office. Banking automation refers to the system ...

A banking system is a group or network of institutions that provide financial services for us. These institutions are responsible for operating a payment system, providing loans, taking deposits ...

1. Core Banking System. Core Banking System automates Banking branch business operations, covers Retail and Corporate Banking Services. It provides a Software solution for General Ledger, Accounts Management, Deposits, Loans, Advances, Bills, Clearing, Sundries (Normal-Accounting), Remittances, Safe-Deposit-Lockers, Safe-Custody-Items and Transaction-Process Etc…

0 Response to "41 us banking system diagram"

Post a Comment